Credit where credit is due

It only takes 3 easy steps to apply for our TruChoice Visa Credit Card and start building or refinancing your credit today.

Apply online

-

My wife and I have been with TruChoice for over five years now. Every interaction with them has been very professional and courteous. We will never go back to a regular bank and will not be leaving TruChoice.

Jim -

My FSR (Financial Services Representative) was very pleasant, knowledgeable, professional, and timely. She quickly responded to my emails and questions.

Robin -

Dealing with Tim has been great. Quick responses, knows answers, and very fast turn around. We moved our two auto loans and TruChoice gave us a cheaper rate! Win!

Sandra -

We love, love, love, doing business with Brittany. She is so true to her members. My husband and I will be transferring EVERYTHING to TruChoice.

Amy -

All was handled in a quick manner. Jessica was so helpful and answered all my questions and concerns.

Linda

Quick reads to help long-term

-

Winter Fun in Maine

At TruChoice, we’re all about finding that sweet spot: maximum Maine fun without financial stress. Whether you’re looking to burn off some energy with the kids, plan a low-key afternoon with friends, or just find a cozy indoor escape from the wind chill, southern Maine has plenty of ways to enjoy the season on a budget. Read More about Winter Fun in Maine10 min about Winter Fun in Maine -

Fresh Starts and Financial Wellness

The holiday decorations are tucked away, the Maine winter has officially settled in, and there’s a brand-new calendar on the wall. At TruChoice, we love the feeling of a fresh start. It’s the perfect time to take a deep breath, look at your goals, and decide how you want your 2026 to look. Read More about Fresh Starts and Financial Wellness10 min about Fresh Starts and Financial Wellness -

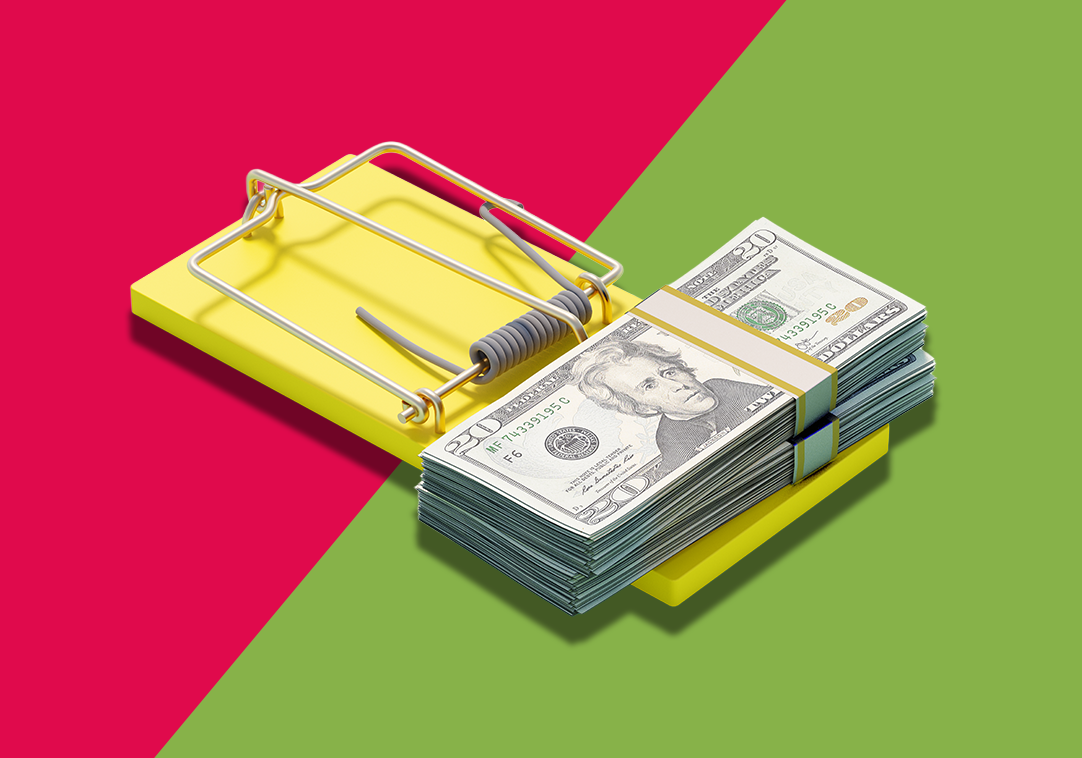

Tips to Scam-Proof Your Holidays

The holidays are such a special time here in Maine. Unfortunately, during this busy time, scammers also ramp up their efforts to take advantage of our generosity and distracted minds. Think of us as your financial winter watch—we’re here to help you enjoy a scam-free holiday! Read More about Tips to Scam-Proof Your Holidays10 min about Tips to Scam-Proof Your Holidays